VAT Exemption

Exempting an Account

To exempt and Account, follow the below steps:

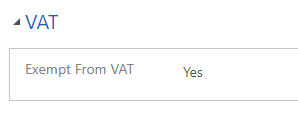

- Go to the Account entity and create or open the account record.

- On the Account form, locate the VAT tab and set the Exempt From VAT field to Yes.

- Click on the Save Button.

Exempting a Contact

To Exempt a Contact, follow the below steps:

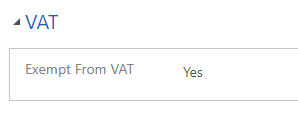

- Go to the Contact entity and create or open the contact record.

- On the Contact form, locate the VAT tab and set the Exempt From VAT field to Yes.

Applying VAT to Products

We describe in this section how to add a VAT rate to a Product or Product Family that will be applied to all Opportunity/Quote/Order/Invoice Products.

To apply the VAT Rate to a Product, please follow the below steps:

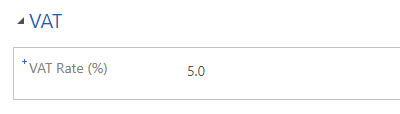

Go to the Products entity and create or open the product record.

On the product form, locate the VAT tab and set VAT Rate (%) field to the desired value between 0 and 100.

Click on the Save button.

General VAT Rate Settings

We describe in this section how to add a default, write in and Parent Product VAT rate that will be applied to all Opportunity/Quote/Order/Invoice Products where the Product has no VAT rate defined.

To set these settings, follow the below steps:

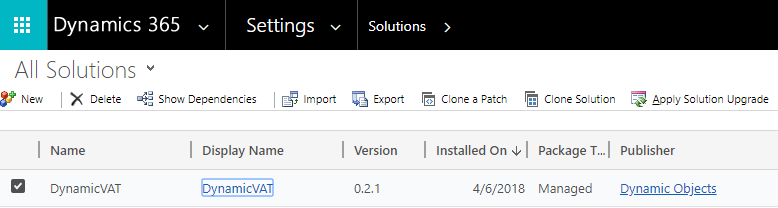

Go to Settings, Solutions and locate the DynamicVAT solution.

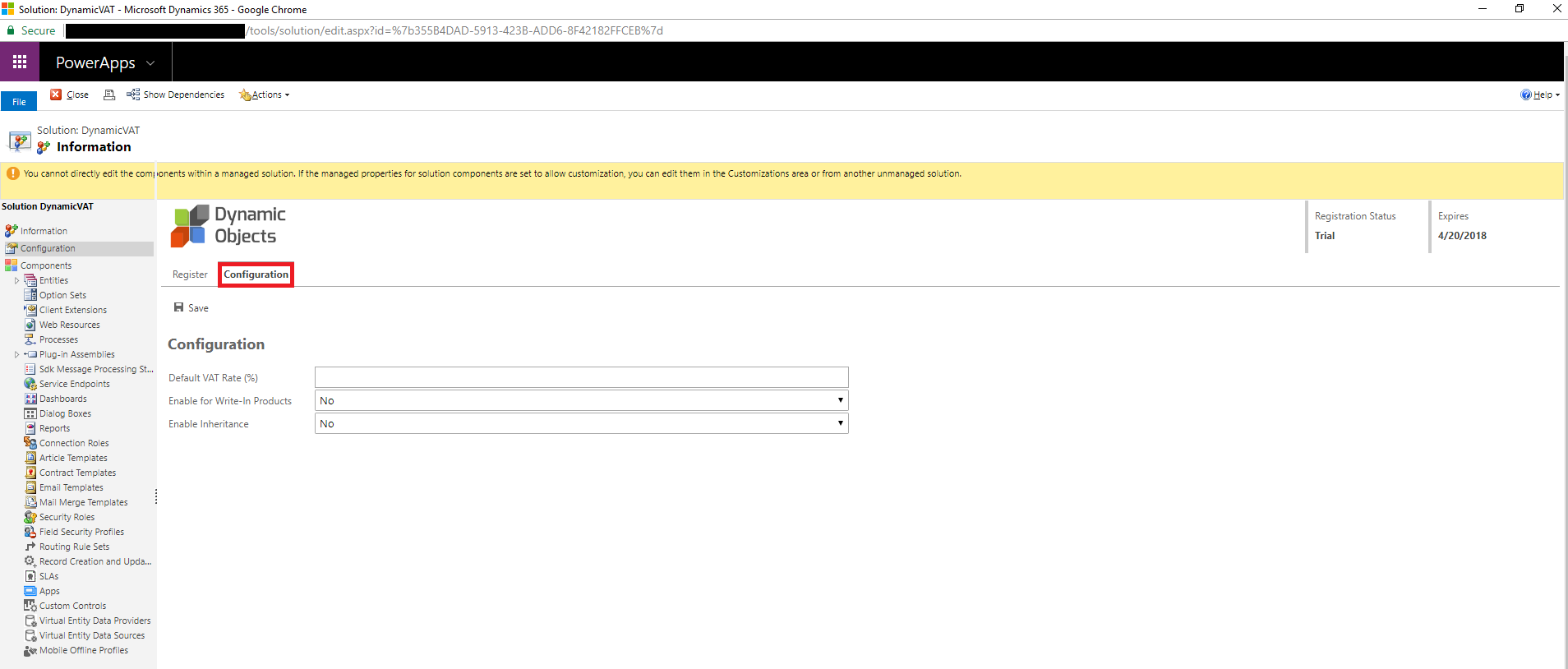

Open the solution and go to Configuration.

-Set the Default VAT Rate (%): This rate applies at the level of the Opportunity/Quote/Order/Invoice Products when the Product selected does not have a rate specified, is not linked to a parent record nor belongs to a product Family.

-Set Enable for Write-In Products: The Tax rate is enabled for Write-In products added at the level of Opportunity/Quote/Order/Invoice Products and the rate is calculated from the Default VAT Rate (%).

-Set Enable Inheritance: When set to Yes, and if the Product selected has no VAT Rate set, the solution will look to the Parent Product specified and uses the corresponding rate.

- Click the Save Button to save the changes.

Auto Calculate VAT

The VAT rate is calculated for each Opportunity Product, Quote Product, Order Product and Invoice Product if applicable.

Note: The user can change or remove the calculated tax from write-in products manually if he chooses to.

The below steps show how to use VAT with Opportunity Products, the same can be applied to Quote/Order/Invoice Products.

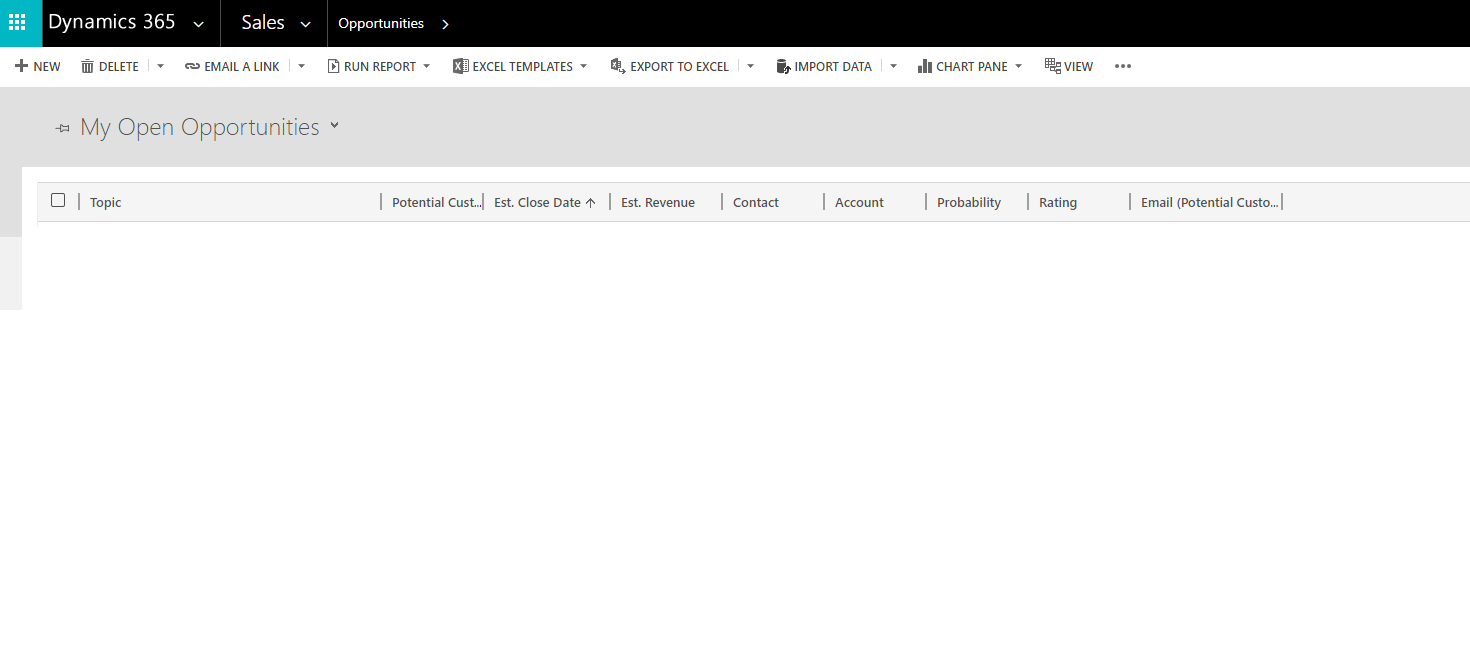

Go to Sales and then Opportunities and create or open the opportunity record.

-Fill in the details needed such as the Potential Customer (Account or Contact), Currency, Default Price List and then go to the Product Line Items Tab.

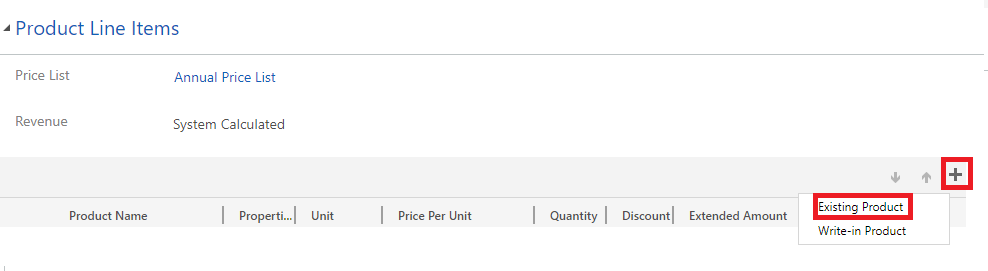

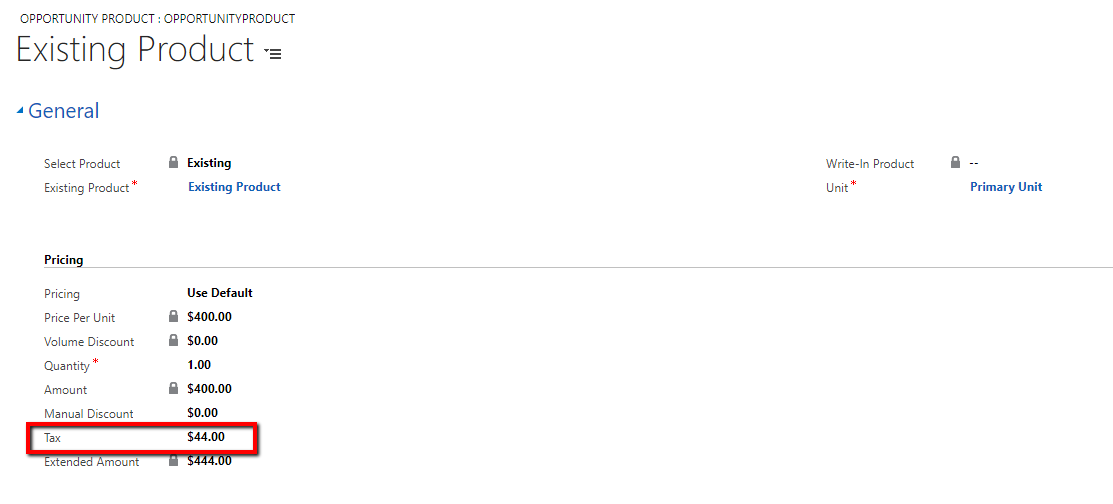

To add an Existing Product, Click the + sign and select Existing Product. Under Product Name, select the product you want. Click the Save Button and the Tax rate is automatically calculated as per the configuration set.

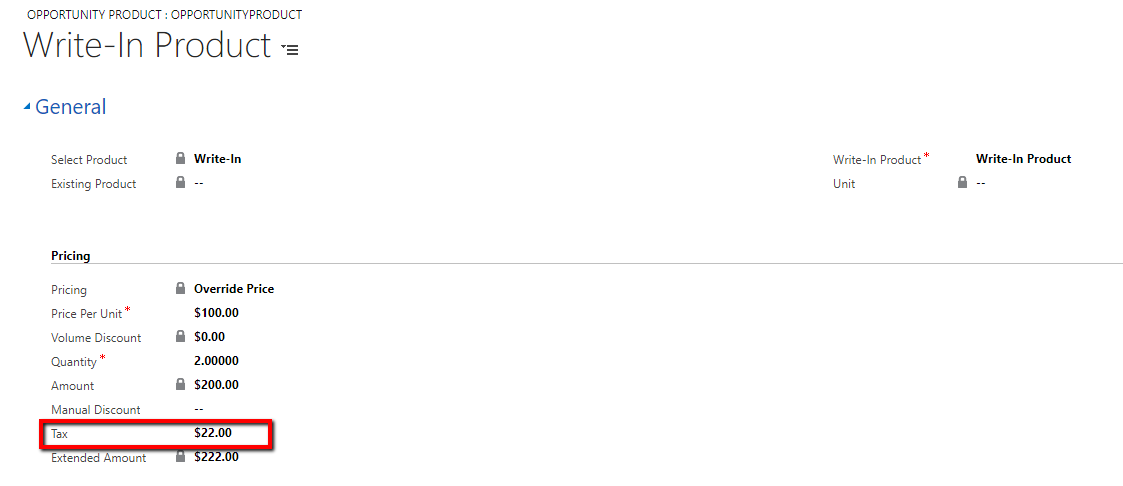

For Write-In products, Click the + sign and select Write-In Product. Under the Product Name, enter the product name, enter the Quantity and Price Per Unit. Click the Save Button and the Tax rate is automatically calculated as per the configuration set.

VAT Profiles

Create and apply multiple VAT profiles to different products and customers.

This solution works well when you have multiple departments operating in multiple countries and you need to apply different VAT rates per area of operation, per product and per customer.

To create and apply a VAT Profile, please follow the below steps:

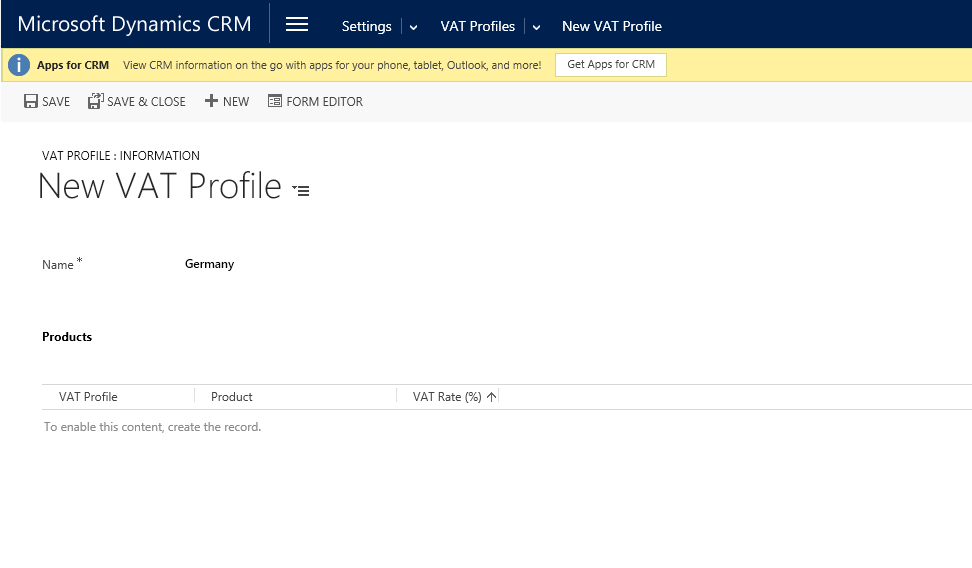

- Go to Settings Area and then click on VAT Profiles.

- Click New to Create a new VAT profile and Name your VAT profile.

- Go to Settings Area -> Product Catalog -> Families and Products.

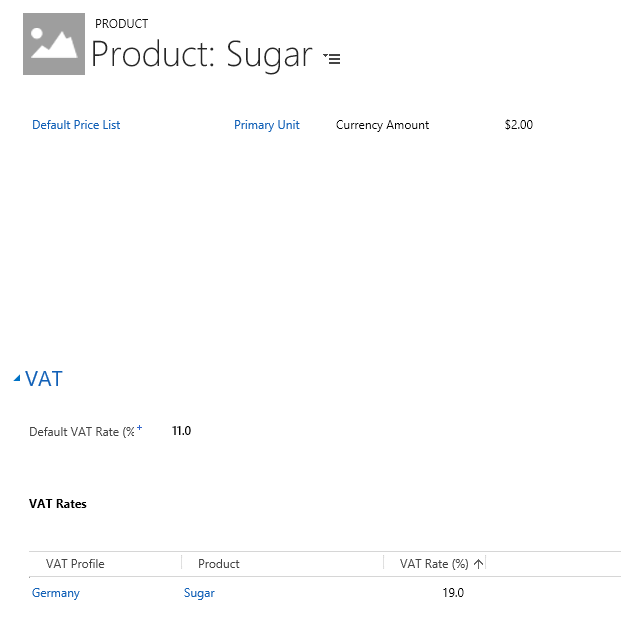

- Search and open the related product record.

- Go to the VAT Rates section and create a new Product VAT Rate.

- Choose the profile record you created and type the respective VAT rate.

- Go to the Account or Contact entity.

- Open the related record and in the VAT tab choose the related VAT profile and then save the record.